HOA Tried to Seize My Farmhouse – Until They Learned I Own Their Neighborhood’s Mortgage Bank!

Sign these papers today or the bank takes your farm tomorrow. The HOA president slid the foreclosure notice across my kitchen table, the same table my greatgrandfather built when he started this farm in 1899. Vivian Hartwell stood there in her tailored suit, flashing that smug smile. >> This land is worth millions now, Mr.

Blackstone. Time to move on. >> She stroed out to her white Mercedes, certain the victory was hers. 20 years ago, I quietly left Wall Street with wealth most people only dream of. Over the years, I made some very private investments in this area. Investments that gave me control over far more than just my own land.

She was about to learn that trying to take my family’s century old legacy came with a price she never saw coming. Let me back up and tell you how a perfectly peaceful retirement turned into the most satisfying financial war I’ve ever fought.

20 years ago, I was the guy who made regional banks very, very rich. On Wall Street, I specialized in community banking acquisitions, swooping in to buy struggling institutions and turning them profitable. When the 2008 crash hit and Regional Trust Bank was hemorrhaging money like a broken fire hydrant, I bought controlling interest for about what most people spend on a decent car.

Here’s the beautiful part. I never told anyone I owned it. Let the management think some mysterious investment group from New York was pulling the strings. Meanwhile, I inherited my great-grandfather’s 40acre farm and decided that collecting fresh eggs beat collecting heart palpitations from Wall Street stress. Picture this.

heritage chickens strutting around heirloom tomato plants. The sound of morning roosters mixing with distant suburban lawnmowers. And the kind of peace you only get when your biggest worry is whether the roosters crowing too early for the neighbors. My hands went from signing million-doll mortgage deals to pulling carrots from soil that had been feeding my family since before cars were invented.

Life was perfect until Vivian Hartwell decided to build her suburban kingdom around me. This woman constructed an entire 180 house subdivision called Hartwell Meadows like some kind of residential fortress completely surrounding my property. She’d tried buying my land during development, offering stupid money that would have set me up for life.

But great-grandfather’s will specifically said no developers ever. Apparently, he had a supernatural gift for predicting the future of suburban hell. Viven’s 47 years old, sharp as a surgical blade, and twice as ruthless. living in a corner mansion that looks like it belongs in a magazine about people who have more money than scents. Every morning, she’d look out her floor to ceiling windows at my weathered farmhouse and probably taste pure rage.

The scent of honest chicken manure drifting across her manicured paradise must have made her question every life choice that led her to this personal nightmare. See, my little farm had cost her millions in development nightmares. Roads had to curve around my property lines like they were avoiding radioactive waste.

Buyers complained about agricultural odors. Apparently, the smell of actual food production deeply offends people who think groceries materialize in supermarkets through some kind of corporate magic. Now, I remembered from my banking days that properties predating zoning laws are grandfathered in and cannot be forced into HOA compliance retroactively, even when surrounded by newer developments.

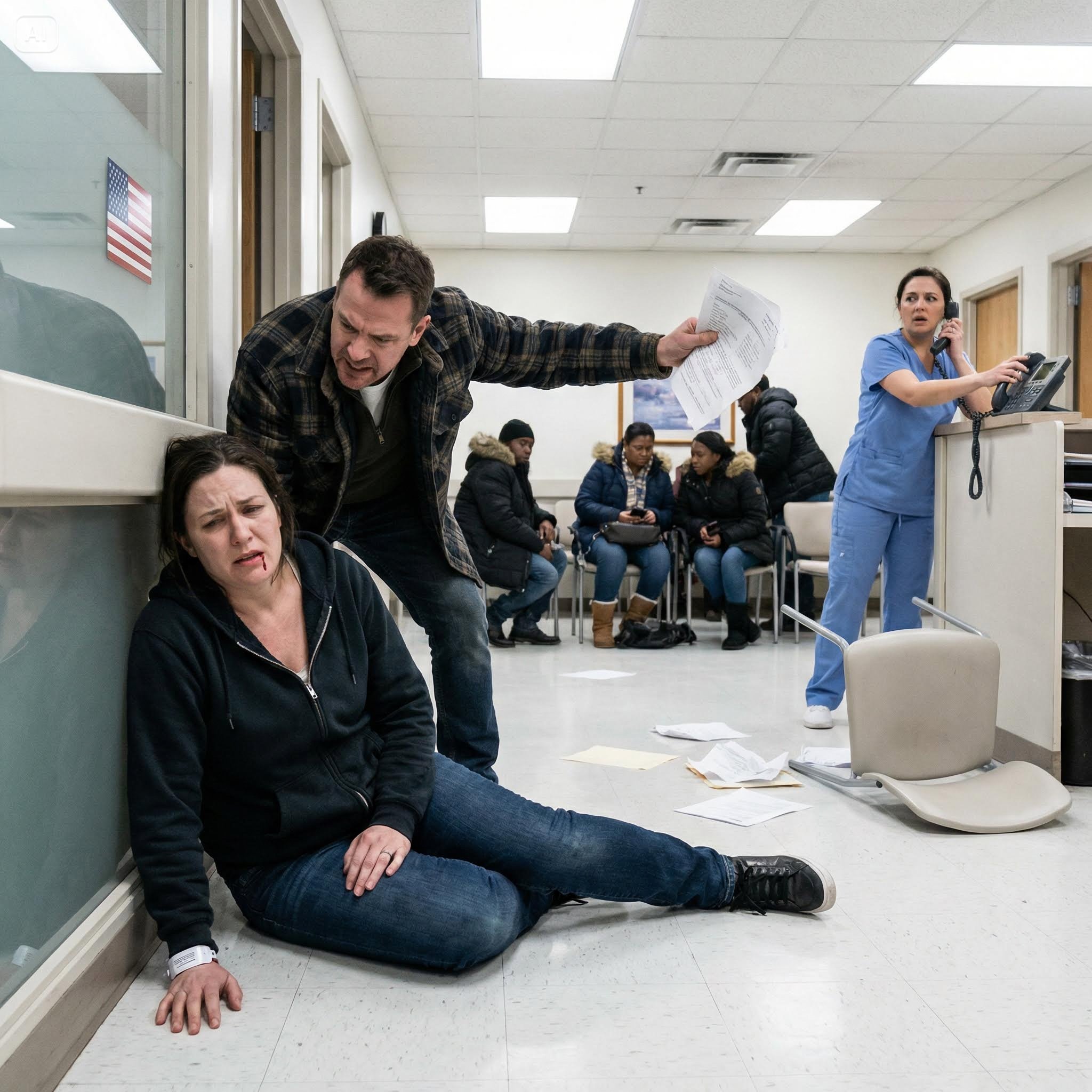

Your property’s legal history always trumps any HOA’s suburban delusions, no matter how many lawyers they can afford. But Viven’s got the persistence of a debt collector and the ethics of a lone shark. Last month, she marched across my porch in heels that probably cost more than most people’s monthly rent, waving legal papers like she was declaring war on behalf of suburban civilization.

We’ve discovered serious irregularities in your property obligations, Mr. Blackstone. That smile could have frozen lava. Apparently, I owed $12,000 in retroactive HOA fees dating back 5 years, plus $50,000 in penalties for non-compliance with covenants that existed only in her twisted imagination. The paperwork looked official enough to fool a federal judge.

Stamps, signatures, legal language designed to terrify anyone who didn’t understand how the financial system actually operates. She’d somehow convinced officers at Regional Trust Bank that my century old farm had been reclassified under HOA jurisdiction through a mysterious boundary revision from 2010. The texture of those documents felt like expensive lies wrapped in legal paper.

“Your family history is quaint,” she’d said, her voice carrying the kind of condescension that makes decent people fantasize about cosmic justice. But banks deal in mathematics, notsentiment. pay immediately or lose everything. Here’s what made my blood boil. She’d been manipulating my own bank to threaten me.

My employees, completely unaware I owned their paychecks, had been feeding her insider information about foreclosure procedures and legal leverage. She’d weaponized my own institution against me. That’s when she slid those foreclosure papers across my kitchen table, absolutely certain she’d just checkmate some helpless old farmer.

What she didn’t realize was that she just declared war on the person who controlled every financial lever in her entire world. The next morning, I decided to pay Regional Trust Bank a friendly little visit. Not as the owner, that nuclear option was staying locked away until the perfect moment. Just a confused old farmer trying to understand how his peaceful chicken coupe had suddenly become a federal foreclosure case.

The bank lobby still had that polished marble smell mixed with the faint aroma of financial anxiety that seems to permanently infuse places where people’s dreams get crushed or approved. I’d personally designed that renovation 20 years ago, back when I naively thought banking was about helping communities instead of watching suburban soap operas unfold in real time. Mr.

Blackstone. Janet Morrison, the loan officer, practically launched herself into orbit when she spotted me. Her coffee cup performed a percussion solo against its saucer. Thank goodness you’re here. We absolutely must discuss your account irregularities. I eased into the chair across from her desk like someone settling in for a friendly chat about the weather while noting how her hands shook like autumn leaves in a hurricane.

Back in my Wall Street days, I’d learned that nervous bank employees usually meant someone was playing fast and loose with regulations that could land entire institutions in federal hot water. Janet, help me understand something. My propertyy’s been in my family since before anyone invented the word subdivision.

How exactly do I owe fees to an organization that didn’t exist when my great-grandfather was building chicken coops? Oh, well, you see, she glanced around like she expected Viven to burst through the ceiling tiles wielding legal documents. Miss Hartwell provided absolutely comprehensive documentation proving your property was officially incorporated into the Hartwell Meadows Covenant through a legitimate boundary revision in 2010.

Everything’s completely above board. Now, I’d spent enough years structuring mortgage deals to know that independent verification of debt claims isn’t just good practice. It’s federal law. Banks can’t simply accept someone’s word about who owes what. Even if that someone drives expensive cars and speaks in legal terminology that sounds impressive to people who don’t know better.

Interesting. Mind if I take a look at that documentation? Janet’s complexion shifted from healthy pink to mortuary white faster than you could say federal banking violation. Well, actually those documents are in Miss Hartwell’s secure file system. She maintains all the originals for proper chain of custody.

Now that afternoon, I called some old colleagues who specialized in what we politely called creative accounting archaeology, following money through more twists and turns than a carnival funhouse. What they uncovered was more beautiful than I dared hope. Viven hadn’t just been lying about my property status. She’d been conducting a symphony of fraud throughout the entire subdivision, inflating property values like a used car salesman describing a rusty Honda as a vintage classic with character.

Her development company had borrowed against fantasy numbers that existed only in PowerPoint presentations and cocainefueled business plans. The sound of my printer running all night was like a lullabi sung by the ghosts of financial justice. every fraudulent appraisal, every backdated document, every loan that violated more federal regulations than a bootleger.

Still, I was building a case that would make prosecutors fight over who got to present it to a grand jury. But here’s where the plot thickened like gravy made with revenge instead of flour. Those astronomical loans all carried Viven’s personal guarantee, meaning her mansion, her car collection, her jewelry box, and probably her designer coffee maker were all collateral for debts that exceeded her actual net worth by roughly the GDP of a small country.

She wasn’t trying to steal my farm because she hated chickens. She was financially drowning and desperately trying to grab anything that might keep her from sinking into bankruptcy court. Meanwhile, Viven launched what military strategists would call a hearts and minds campaign. If military strategists specialized in terrifying suburban homeowners with economic horror stories.

“Dear friends and neighbors,” she proclaimed from her marble throne room, surrounded by catered refreshments and residents who looked like they’d ratherbe getting root canals were facing a community crisis that threatens everything we’ve worked to build here. The smell of expensive cheese couldn’t mask the odor of pure panic as she painted apocalyptic visions of plummeting property values and mortgage catastrophes.

People who’d invested their life savings in suburban paradise started imagining foreclosure notices arriving like Christmas cards from hell. Mrs. Patterson burst into tears when someone mentioned the possibility of underwater mortgages. And suddenly half the neighborhood was treating me like I carried some kind of financial plague that might infect their 401k plans.

But Viven’s desperation made her sloppy. And sloppy criminals leave evidence like breadcrumbs for anyone smart enough to follow the trail. Ms. Kowalsski appeared at my kitchen door that evening, clutching an envelope like she’d discovered evidence of alien visitation. At 78, she had the survival instincts of someone who’d weathered the depression and could smell from three zip codes away.

Ezra, this woman has completely lost her mind. She spread photographs across my table, pictures of my property taken from various angles along with a formal document requesting sworn affidavit regarding public health violations and property value degradation. She offered to pay my HOA fees for the next 2 years if I’d testify that your chickens are causing health problems.

Mrs. Kowalsski said, her voice vibrating with righteous fury. 2 years? as if I’d sell my soul for the price of lawn maintenance. That’s when the beautiful irony hit me like a freight train made of poetic justice. Viven had just graduated from financial fraud to soliciting perjury from senior citizens. She’d handed me enough federal crimes to keep prosecutors busy until her great-g grandandchildren graduated college.

Time to show this suburban shark what happens when you swim into waters controlled by someone who actually knows where all the financial bodies are buried. The next morning, I strolled into that regional trust conference room like someone attending a friendly neighborhood barbecue, carrying a briefcase that contained enough evidence to turn three banking careers into cautionary tales.

The officers sat around the polished table looking like they’d been caught stealing lunch money from orphans. Fresh coffee couldn’t mask the distinctive scent of professional panic that fills rooms where people suddenly realize they’ve been played by someone much smarter than they are. Gentlemen, thank you for accommodating this meeting.

I spread documents across the table with the careful precision of someone who’d done this dance on Wall Street for two decades. I have some concerns about Regional Trust’s recent lending practices that I think you’ll find educational. Branch manager Tom Williams tried maintaining his customer service smile, but sweat was already beating on his forehead like guilt made visible.

Of course, Mr. Blackstone, we’re always eager to address customer concerns. Excellent. Let’s start with federal banking regulation basics, like why you’re attempting to foreclose on property for debts that don’t exist. I slid a highlighted document across the smooth mahogany surface. See, back in my finance days, I learned that independent verification isn’t a suggestion.

It’s what prevents banks from becoming unwitting accompllices to fraud. The silence that followed was broken only by papers rustling as they grasped the magnitude of their regulatory violation. The wall clock’s ticking sounded like a countdown timer to someone’s unemployment. “We relied on comprehensive documentation from Ms.

Oartwell,” Janet whispered, her voice carrying the defeated tone of someone watching their career dissolve in real time. “Ah, Ms. Hartwell.” I opened another folder with the theatrical flare of a magician revealing his best trick. The same woman whose development company has borrowed money with the fiscal responsibility of a lottery winner on a cocaine bender using property appraisals so creatively inflated they belong in a museum of financial fiction.

I’d spent the previous evening following money trails that twisted through more shell companies than a Russian oligarch’s tax strategy. Every loan in Hartwell Meadows told the same story. fantasy valuations, rubber stamp approvals, and Viven’s signature promising payments that would require her to discover buried treasure or marry Jeff Bezos.

“Here’s what happens next,” I said, settling back with the calm authority of someone who’d negotiated bigger deals before breakfast. “You withdraw that foreclosure immediately. You implement actual verification procedures, and you pray that federal regulators don’t decide to make an example out of regional trust.

” Their nodding reminded me of dashboard bobbleheads in a car driving over railroad tracks. But Vivien wasn’t finished demonstrating the depths of her vindictive creativity. 2 days later, Mrs. Kowalsski knocked onmy door, tears streaming down weathered cheeks that had seen seven decades of life’s ups and downs. She clutched a legal document that shook in her hands like evidence of injustice made tangible.

“Ezra, they’re trying to steal my home.” Her voice cracked with the pain of someone discovering that evil sometimes wears expensive suits. They claim I’ve defaulted on mortgage payments, but I’ve never been late once in 15 years. Never. The foreclosure notice felt like sandpaper between my fingers as rage crystallized into something cold and focused.

Viven had weaponized the bank against an elderly woman whose only crime was refusing to commit perjury about my chickens allegedly causing neighborhood apocalypse. This is retaliation, pure and simple, I told her, my voice steady despite the fury building like pressure in a boiler. She’s punishing you for having integrity.

That evening, I accessed Regional Trust’s complete digital archives with the systematic thoroughess of someone conducting financial surgery. What I discovered was more damning than I dared hope. Email conversations between Viven and loan officers discussing expedited approvals and flexible interpretations of lending standards.

Mysterious cash deposits that appeared in personal accounts shortly after favorable loan decisions. A paper trail that connected dots into a picture of systematic corruption. The smoking gun was a recorded phone call where Viven explicitly discussed compensation arrangements for overlooking certain regulatory requirements.

In banking law, such conversations are treated like confessions written in blood and witnessed by federal judges. But the real revelation came buried in corporate records that read like a masterclass in financial deception. Viven’s development company was secretly controlled by her ex-husband’s bankruptcy attorney, the same lawyer who’d helped her hide millions during their divorce proceedings. This wasn’t just fraud.

It was organized conspiracy involving officers of the court who’d forgotten that law degrees come with ethical obligations. She documented her own criminal enterprise like someone writing a how-to manual for federal prosecutors. I organized everything into folders labeled with federal statute numbers, each representing another year of potential prison time.

The texture of compiled evidence felt like justice taking physical form. Then I made the call that would end Vivian’s reign of suburban terror. FDIC fraud investigation unit. How can I help you? I need to report systematic lending violations at Regional Trust Bank. The kind that involve millions of dollars, multiple federal statutes, and enough documented evidence to make prosecutors fight over who gets to present the case.

Please hold while I connect you with our senior investigator. 2 hours later, I was speaking with someone whose excitement was audible through the phone. Within 24 hours, federal examiners descended on regional trust like antibodies attacking an infection. Viven’s financial house of cards was about to collapse, and she’d built it tall enough that the crash would be visible from space.

The Federal Bank examiners worked with the methodical precision of surgeons removing a cancer. except their patient was a financial institution and the cancer was four years of systematic fraud dressed up as suburban development. For three days, they dissected regional trusts lending practices while Viven paced her mansion like a caged predator who’d suddenly realized the cage was made of federal banking regulations.

I watched the investigation unfold from my kitchen window while sipping coffee from the same chipped mug my great-grandfather had used for 40 years. The irony tasted sweeter than honey. I was witnessing the systematic dismantling of corruption at an institution I owned, perpetrated by a woman who had no idea she’d been stealing from her own mortgage holder.

On the fourth morning, senior examiner Patricia Hris called me with news that made my day brighter than Christmas morning. Mr. Blackstone, what we’ve uncovered is absolutely spectacular. This case will be taught in federal law enforcement for decades. I arrived at Regional Trust to find the lobby transformed into a white collar crime scene that would make FBI training videos jealous.

Boxes of evidence lined the walls and federal agents moved between workstations with the focused intensity of hunters who’d cornered the world’s most well doumented criminal. The smell of fresh printer ink mixed with the electric tension of pending federal indictments hanging in the air like storm clouds gathering for a perfect hurricane.

Patricia led me to the conference room where nervous loan officers had once tried to explain away obvious fraud. Now the mahogany table was covered with enough evidence to convict a small corporation. Each folder representing another felony charge with Viven’s name on it. Mr. Blackstone, what we’ve discovered is a masterclass in hownot to commit financial crimes.

She opened a folder thick enough to stop small caliber bullets. four years of systematic fraud documented with the thoroughess of someone writing their own criminal confession. She spread documents across the table like a dealer revealing a winning hand in federal prosecution poker. Loan applications with forged signatures that wouldn’t fool a kindergarten teacher.

Property appraisals inflated beyond the realm of mathematical possibility. Email communications discussing federal law violations like they were suggestions for weekend activities. The texture of comprehensive stupidity felt almost educational as I examined each piece of evidence. 20 years in banking had taught me to recognize fraud.

But this was performance art. If criminal conspiracy could be considered artistic expression. Total exposure. 47 million in fraudulent lending. Patricia continued, barely containing her excitement. All tied to one development project. All personally guaranteed by someone who apparently failed basic mathematics in elementary school. Vivien Hartwell, I presume.

Precisely. But here’s where it gets beautiful. Patricia’s smile could have powered a small city. Her personal guarantees exceed her net worth by $8 million. She’s pledged everything she owns and everything she doesn’t own as collateral for impossible debts. But then, Patricia revealed something that made my blood freeze with pure rage.

However, we’ve discovered she’s been liquidating assets and transferring money offshore for the past 2 weeks. Swiss bank accounts, Cayman Island investments, even cryptocurrency wallets. She’s preparing to run. The mini twist hit me like a sledgehammer. While I’d been building a case against her, Viven had been planning her escape with stolen community funds.

She wasn’t just a financial predator. She was a flight risk with a head start. We estimate she’s moved approximately $2.3 million in HOA funds to international accounts, Patricia added grimly. If she disappears, your neighbors lose everything. That’s when I realized the beautiful irony of my position. As bank owner, I could freeze her accounts, block wire transfers, and trap her financially before she could flee with the community’s money.

I pulled out my phone and called Regional Trust’s wire transfer department. This is Ezra Blackstone. I’m invoking executive authority to freeze all outgoing international transfers from any account associated with Viven Hartwell or Hartwell development. Effective immediately. Patricia watched with growing amazement as I systematically dismantled Viven’s escape plan in real time. You can do that.

Patricia, there’s something I should mention about Regional Trust’s ownership structure. I reached for my briefcase with the satisfaction of someone about to play their royal flush. I don’t just bank here. I own this institution. The silence that followed was so complete I could hear the building’s air conditioning cycling on.

Patricia stared at me like I just announced I was actually Superman masquerading as a farmer. “You own the bank,” she whispered, testing each word for hidden implications. “Lock, stock, and apparently every fraudulent loan Viven’s been cooking up for 4 years. She’s been trying to steal from the person who controls her credit lines, her mortgage, and every financial lever in this community.

” Patricia’s expression shifted from professional composure to something approaching awe. This just became the most ironically perfect case in federal fraud history. I smiled and opened my briefcase. Patricia, let me show you exactly how we’re going to catch a financial predator using her own greed as the trap.

The hunter was about to become the hunted, and she’d provided all the weapons. The look on Patricia’s face when I revealed my ownership was worth every sleepless night I’d spent building this case. Her jaw dropped so fast I worried she might dislocate something, staring at me like I’d just announced I was Batman hiding in plain sight as a chicken farmer.

“You own the bank,” she whispered, her voice carrying the awe of someone witnessing a miracle wrapped in poetic justice. “The fraud victim owns the defrauded institution. every marble tile, every loan document, and apparently every criminal scheme Viven’s been running. I pulled out corporate papers with the satisfaction of someone revealing the ultimate plot twist.

Patricia, this isn’t just an investigation anymore. It’s financial poetry. But federal justice crawls slower than bureaucracy and molasses. I needed a solution that moved at the speed of community outrage and righteous fury. That evening, I assembled my war council in the barn where great-grandfather had crafted furniture and probably plotted his own battles against injustice.

The rich smell of aged hay mixed with determination as Mrs. Kowalsski arrived carrying coffee that could wake the dead, her eyes blazing with 78 years of accumulated wisdom about fighting bullies.”That woman made a fatal mistake,” she announced, settling into a chair that creaked like old bones, ready for one final fight.

She threatened the wrong grandmother about her mortgage. I’ve been organizing this neighborhood longer than she’s been breathing through her surgically perfect nose. Dimmitri clanked in with his toolbox full of evidence, grinning like someone who’d waited decades to expose shoddy construction. I have photographs of violations that would make building inspectors resign in shame.

This woman cut corners that don’t exist. Sarah burst through the door, clutching folders thick enough to educate a law school. her teacher energy crackling like electricity during a thunderstorm. 68% resident support for emergency audit. People are furious. She’s been stealing their money while threatening their homes.

The texture of synchronized rebellion felt electric as we spread evidence across saw horses that had supported honest work for generations. This wasn’t just about stopping Viven anymore. It was about saving a community she’d been systematically destroying. Here’s our coordinated strike, I said, laying out a timeline that would make military strategists weep with appreciation.

Tuesday morning, Demetri County inspection reveals safety violations requiring immediate expensive repairs. Tuesday afternoon, Sarah’s petition forces emergency HOA meeting with mandatory financial disclosure. Tuesday evening, I reveal bank ownership and trigger every default clause in Viven’s personal guarantees.

But what if she runs? Mrs. Kowalsski asked, her survival instincts sharp as broken glass. Already handled, I’ve frozen her accounts and alerted federal marshals. She’s trapped in a financial cage she built herself. I smiled with the satisfaction of someone who’d thought three moves ahead. The beautiful part, every desperate move she makes now just adds more federal charges.

Sarah leaned forward with the intensity of someone who’d found her life’s purpose. The community meeting will be packed. People want answers about their missing money and they want them publicly. County will condemn half the infrastructure, Dmitri added with grim satisfaction. Repairs will cost more than HOA has left after her theft.

Perfect financial pressure. Mrs. Kowalsski’s weathered hands trembled with excitement rather than age. And when residents see the federal agents at that meeting, they’ll understand she’s not just a bad neighbor. She’s a criminal who’s been robbing them blind. The sweet aroma of approaching victory mixed with honest barn dust as we finalized our strategy.

Viven had built her empire on lies, theft, and intimidation. Time to show her what happens when a community discovers its strength and decides to use it against someone who forgot that neighborhoods are built on trust, not terror. Tomorrow we end her reign of suburban tyranny, I said, closing my briefcase with the finality of a judge’s gavvel.

The revolution would be locally organized and federally prosecuted. Tuesday morning arrived like the opening scene of a perfectly choreographed revenge thriller complete with federal agents, county inspectors, and one very desperate suburban criminal about to discover that cornered animals make the most spectacular mistakes.

Dimmitri’s county inspection team rolled up at dawn like a small army of building code enforcement, their clipboards gleaming in the morning sunlight. By noon, they’d plastered the subdivision with enough violation notices to wallpaper a courthouse. The smell of fresh citation ink mixed with the distinctive aroma of Viven’s mounting panic as she realized her years of corner cutting had just become a quarter million dollar repair bill.

I was checking my chicken coupe when my phone rang with an unknown number. The voice belonged to someone who introduced himself with the authority of law enforcement and the confusion of someone who’d been fed a steady diet of lies. Mr. Blackstone, Detective Ray Morrison, County Sheriff’s Department. We’ve received some very serious allegations about your conduct that require immediate investigation.

The irony tasted like fine wine aged to perfection. Viven was trying to get me arrested for her own crimes. Probably hoping to buy time for whatever desperate escape plan she’d been hatching since the federal examiners arrived. What kind of allegations, detective? Financial intimidation of elderly residents, conspiracy to defraud community institutions, and abuse of banking authority to threaten innocent homeowners.

His voice carried the weary tone of someone reading from notes that didn’t quite make sense. I’d be happy to cooperate with any investigation detective. In fact, I have some documentation you might find illuminating about actual financial crimes in this community. 3 hours later, Detective Morrison sat in my kitchen examining evidence that made his expression shift from professional skepticism to the kind of amazement reserved for discovering buried treasurein your own backyard.

The texture of comprehensive documentation felt satisfying as I watched him realize he’d been sent to arrest the victim instead of the perpetrator. “Mr. Blackstone,” he said slowly, spreading bank records across my great-grandfather’s table. “These anonymous allegations appear to be strategically misleading. What you’ve shown me suggests someone’s been playing elaborate games with law enforcement.

” But Viven’s master stroke of desperation was yet to come. That evening, as residents packed the community center for Sarah’s emergency HOA meeting, the unmistakable sound of diesel engines rumbled through the subdivision like mechanical thunder. Mrs. Kowalsski called with the breathless excitement of someone witnessing history unfold in real time.

Ezra, there’s a moving truck in Viven’s driveway. She’s loading boxes like the house is about to be condemned. Designer furniture, expensive art, even that ridiculous collection of crystal animals she’s always bragging about. I drove toward Vivien’s mansion with the focused intensity of someone about to witness the final act of a 4-year criminal enterprise.

The site that greeted me belonged in a museum of spectacular bad decisions. Viven was directing three confused movers in the frantic choreography of someone whose world was collapsing faster than a house of cards in a tornado. Boxes marked urgent and priority international shipping were being loaded while she barked orders at workers who clearly wondered why anyone packed Ming vases at 9:00 at night.

The texture of pure panic radiated from her like heat waves off summer asphalt. Going somewhere, Vivien? She spun around with the grace of someone caught stealing from the church collection plate. Her face cycling through emotions like a malfunctioning slot machine. surprise, rage, terror, and finally settling on the kind of cornered animal calculation that makes criminals do spectacularly stupid things.

Ezra, her voice could have frozen boiling water. I should have expected you to skullk around like some kind of agricultural stalker spying on your betters. Just wondering why you’re relocating at midnight while federal agents are building a case that could put you in prison until your great grandchildren need reading glasses. Her diamond rings click together like castinets played by someone having a nervous breakdown.

You have no comprehension of what you’re interfering with. This community, that pathetic bank, these sheep who call themselves neighbors, they’re all components of something far more sophisticated than your barnyard brain could possibly understand. That’s when I noticed something that made my blood turn to ice water in my veins.

The boxes weren’t just personal belongings. Through gaps in hastily applied tape, I could see HOA financial records, thick folders of resident personal information, and what looked like computer drives containing banking data she’d systematically stolen from regional trust over the past 4 years. She wasn’t just fleeing prosecution. She was planning to establish her criminal enterprise internationally, using stolen community data as startup capital for fraud operations that would make her current schemes look like petty theft.

Those boxes contain federal evidence and stolen personal information. Viven, taking that material across state lines transforms local fraud into international criminal conspiracy. Her smile could have powered a nuclear reactor with pure malevolence. Prove it, farmer boy. By tomorrow morning, I’ll be conducting business from somewhere your pathetic federal friends can’t even pronounce, let alone extradite from.

She’d just graduated from garden variety fraud to data theft, flight to avoid prosecution, and what sounded remarkably like threats against a federal investigation. The woman was collecting felony charges, like some people collect vintage wines. And she was about to discover that threatening someone who controlled every aspect of her financial existence, was the kind of mistake that transforms white collar prison sentences into hard-time federal accommodations.

I pulled out my phone and speed dialed Patricia Hendris while Viven watched with the expression of someone who’ just realized they might have made a tactical error roughly equivalent to declaring war on the United States using water balloons. Patricia, it’s Ezra. Our suspect is currently loading federal evidence into moving trucks while threatening to flee the country.

You might want to expedite that arrest warrant. FBI units are 2 minutes out. Patricia’s voice crackled with barely contained excitement. Local news crews are following. This is about to become very public. The color drained from Viven’s face faster than water from a broken bathtub. She’d spent four years operating in shadows and backroom deals, but federal arrests tend to happen under bright lights with lots of cameras rolling.

You called the media? Her voice pitched higher than a smoke alarm in ahouseire. This is a private community matter. Private community matters don’t usually involve stolen federal banking records and international flight to avoid prosecution. I replied, watching neighbors emerge from their houses like audience members filing into a theater for the most important show of the decade.

The sound of approaching sirens mixed with the rumble of news van generators as Hartwell Meadows transformed into the epicenter of suburban justice. Red and blue lights painted the mansion’s white columns while satellite dishes extended like mechanical flowers blooming toward the night sky. But Viven’s final desperate gambit was more twisted than I’d imagined possible.

As federal agents poured out of black SUVs like a coordinated invasion force, she grabbed a small device from her designer purse and held it above her head like she was brandishing a digital weapon of mass destruction. “This contains every piece of personal information on every family in this subdivision,” she announced with the theatrical desperation of someone whose world was collapsing in real time.

bank accounts, social security numbers, children’s school records, medical information, everything needed to destroy their lives completely. The device looked innocuous, just a small USB drive. But the implications made my blood run cold. She’d been systematically harvesting residents personal data for years, building a digital arsenal of identity theft that could destroy dozens of families. Mrs.

Patterson burst into tears when she realized what Viven was threatening. Other neighbors pressed closer, their faces showing the kind of horror reserved for discovering that the person you’d trusted with your community had been planning to sell your family’s future to the highest bidder. One wrong move, Viven continued, her voice carrying the manic edge of someone who’d crossed the line from white collar crime into digital terrorism, and I upload everything to networks that specialize in identity destruction. But as she

waved that USB drive like a magic wand that could save her from federal prosecution, I realized something that made this moment even more ironically perfect. The device she was using to threaten my neighbors was actually accessing Regional Trust’s secure network, the same network I controlled as bank owner.

I pulled out my phone and called our IT security department while Viven continued her digital hostage negotiation. Emergency security protocol activation. This is Ezra Blackstone. Lock down all network access from unauthorized devices immediately. The look of confusion on Viven’s face was priceless as she frantically pressed buttons and discovered her digital weapon had been neutralized. That’s impossible.

You can’t just shut down my access. Actually, as the person who owns the network you’ve been illegally accessing, I can and just did. That’s when the beautiful chaos began. Federal agents moved toward the front entrance with tactical precision. their flashlights cutting through darkness like search lights hunting escaped prisoners.

But Viven had spent four years planning for exactly this moment. While agents surrounded the front of the mansion, she bolted toward the back garage with the desperate speed of someone whose freedom depended on reaching her escape vehicle before handcuffs could end her criminal career permanently. “She’s running!” Mrs. Kowalsski shouted, pointing toward the garage where engine sounds indicated Viven had reached her backup Mercedes.

the one agents hadn’t known about because it was registered under one of her shell companies. Tires squealled against asphalt as Viven’s escape vehicle shot out of the garage like a rocket fueled by pure panic and federal felony warrants. Federal agents scrambled toward their own vehicles, but suburban driveways weren’t designed for high-speed pursuit operations.

The sound of FBI radio communications crackled through the night air. Suspect has fled the scene in dark Mercedes sedan. License plate unknown. All units respond for pursuit operations. She’d left behind boxes of evidence, financial records, and enough documentation to convict her in absentia, but Vivian Hartwell had successfully escaped federal custody with stolen community data and approximately $3 million in offshore accounts.

As news helicopters appeared overhead like mechanical vultures circling a crime scene, I realized this wasn’t the ending anyone had expected. The woman who tried to steal my farm had just transformed from suburban criminal into international fugitive. And the real chase was just beginning. Wednesday morning brought news that made my coffee taste like cold revenge mixed with federal incompetence.

Patricia Hendrickx called at dawn with the kind of update that makes law enforcement professionals question their life choices. She ditched the Mercedes 20 m outside the city and disappeared completely. Patricia’s voice carried the frustration of someone watching a perfectly goodcase turn into an international incident.

Airport security footage shows her boarding a private jet using a fake passport we didn’t even know existed. The sound of FBI helicopters circling the subdivision like mechanical vultures had become the new soundtrack of Hartwell Meadows. Their rotors beating a rhythm that reminded everyone that their former HOA president had just transformed from local criminal into international fugitive.

How much did she steal in total? I asked, though I suspected the answer would require blood pressure medication. Conservative estimate: 2.3 million from various offshore accounts, plus the USB drive containing personal information on every family in your subdivision. She’s been planning this escape route for months, maybe years.

The community’s reaction was swift and predictable. Within hours of news breaking about Viven’s escape, for sale, signs began sprouting throughout the neighborhood like weeds after a spring rain. The texture of panic was almost tangible as residents imagined their property values crashing due to association with federal crimes and international fugitive investigations.

Mrs. Patterson called in tears, convinced that living in a criminal subdivision would destroy her family’s equity. The Hendersons started packing boxes before lunch, and three other families were researching emergency real estate agents who specialized in distressed community sales. The smell of fear had replaced the usual suburban sense of lawnmower exhaust and barbecue smoke as people wondered whether their quiet neighborhood would forever be known as that place where the fugitive lived. That’s when I realized the

community needed leadership more than it needed another update about international manhunts and Swiss banking investigations. I called an emergency neighborhood meeting for that evening, using every available communication channel to remind people that actual human connection still mattered more than cable news updates about Costa Rican extradition treaties.

The community center filled with residents whose faces ranged from terror to curiosity about what their chicken farming neighbor might have planned to salvage their collective sanity. The scent of determination was slowly replacing the earlier aroma of panic as 87% of homeowners showed up for what would become the most important community meeting in subdivision history.

Friends, I began standing at the same podium where Viven had once spread lies about property values. I know you’re scared. I know some of you are considering abandoning the homes you’ve spent years building equity in. The sound of nervous breathing and shifting chairs filled the room like a congregation waiting for either salvation or confirmation that their worst fears were justified.

But here’s what I want you to understand. As owner of Regional Trust Bank, I’m personally guaranteeing every mortgage in this subdivision. Your homes are safe, your equity is protected, and Vivian Hartwell will not destroy this community from whatever beach she’s currently hiding on. The collective sigh of relief was audible enough to register on seismic equipment, followed by murmurss that gradually shifted from panic to something approaching cautious optimism.

Meanwhile, the international manhunt was providing entertainment that made reality television look like amateur hour. Viven had been spotted in the Cayman Islands arguing with luxury hotel staff about presidential suite accommodations that apparently didn’t meet her standards for international fugitive lifestyle maintenance. Federal marshals were coordinating with authorities across six countries, while forensic accountants traced money through more shell companies than a Russian oligarch’s estate planning strategy. The sound of calculators and

printers working overtime at the federal building was audible from three blocks away as prosecutors built an extradition case that would make international law textbooks. But something beautiful was happening back in Hartwell Meadows. Instead of fleeing like rats from a sinking subdivision, residents began working together with the intensity usually reserved for natural disaster recovery. Mrs.

Kowalsski was unanimously elected as interim HOA president, running on a platform of complete transparency, absolute accountability, and homemade perogi for every board meeting. Her first official act was implementing emergency financial controls that would prevent any future suburban tyrant from accessing community funds without written approval from at least 12 residents.

Dmitri organized volunteer construction crews to begin emergency infrastructure repairs using funds I’d advanced against future asset recovery operations. The texture of neighbors actually helping each other instead of communicating through formal violation notices felt revolutionary. After years of Viven’s divide and conquer management style, Sarah established resident committees forfinancial oversight, community safety, and long-term planning that would ensure no future HOA leader could accumulate the kind of unchecked power that Viven

had systematically abused. The media attention was surprisingly positive. National news networks interviewed residents about their experiences with financial intimidation and suburban tyranny, creating awareness about HOA abuse that was spreading beyond our little community. But the real shock came when federal investigators revealed the ultimate twist.

Viven’s divorce had been completely fabricated. Her ex-husband was actually her co-conspirator and their bankruptcy attorney had been laundering money through legal fees for over 5 years. The federal RICO case now included organized criminal enterprise charges that would make extradition a formality rather than a legal challenge.

3 weeks later, the news that everyone had been waiting for finally arrived. Patricia Hendrickx called at 7:00 in the morning with the kind of excitement that made her voice crack like a teenager announcing prom dates. We got her, Ezra. Costa Rican authorities arrested Viven at a luxury resort where she’d been living under a fake identity.

She’s being extradited today. The sound of camera shutters clicking like machine guns filled the air outside the federal courthouse as news crews positioned themselves for what media outlets were calling the perp walk of the decade. Vivian Hartwell was coming home in federal custody and apparently everyone within 50 mi wanted front row seats for the spectacle.

I arrived at the courthouse to find a crowd that looked like a combination of justice seeking neighbors, curious onlookers, and enough media personnel to cover a presidential inauguration. The community had turned out in force. Mrs. Kowalsski in her best dress, Dmitri carrying a sign that read, “Criminals belong in prison, not presidential suites.

” And Sarah with a folder of resident testimonials thick enough to serve as evidence in multiple federal trials. The tension in the air was thick enough to cut with a knife as federal marshals announced that the prisoner transport would arrive within the hour. Television crews tested their equipment while residents shared stories about years of intimidation and financial abuse they’d been too frightened to discuss publicly.

When the federal transport vehicle finally arrived, the crowd fell silent with the kind of anticipation usually reserved for watching history unfold in real time. Viven emerged in orange prison clothing and federal restraints. Her designer wardrobe replaced with institutional attire that made her look like exactly what she was.

A common criminal who’d been caught stealing from her neighbors. The woman who’d once terrorized elderly residents with threats about property taxes and foreclosure proceedings now looked smaller somehow, diminished by the reality of federal prosecution and international extradition proceedings that had stripped away her suburban authority along with her freedom.

But the real show was yet to come. An emergency community meeting had been scheduled for that evening, and every resident in Hartwell Meadows seemed determined to attend what local media were calling the most dramatic HOA meeting in suburban history. The community center was packed beyond capacity with 95% resident attendance and enough federal agents, media crews, and county officials to make the gathering feel like a combination of town hall meeting and federal court proceeding.

US attorney Rebecca Morrison took the podium with the confident authority of someone about to announce the successful conclusion of a case that would be studied in law schools for decades. Behind her, a projection screen displayed financial charts that told the complete story of Viven’s 4-year crime spree in language simple enough for elementary school students to understand.

Ladies and gentlemen,” Morrison announced, her voice carrying across the packed room like a declaration of victory over suburban tyranny. “Today marks the conclusion of one of the most comprehensive financial fraud investigations in federal history.” The room fell silent except for the quiet hum of recording equipment capturing every word for prime time news broadcasts and federal case study documentation.

Over the past four years, Vivien Hartwell systematically embezzled $1.2 $2 million from HOA reserves, defrauded regional trust bank of $47 million through falsified loan applications, and stole personal identity information from 180 families for potential sale to criminal networks. Each number hit the audience like physical blows, gasps, and murmurss rippling through the crowd as people fully grasped the scope of crimes that had been committed against their community while disguised as neighborhood management.

The scent of relief mixed with vindication filled the air as residents realized their years of suspicion and fear had been completely justified. However, Morrison continuedwith a smile that could have powered the entire building due to extraordinary cooperation from regional trust banks ownership and comprehensive asset recovery operations were pleased to announce that 100% of stolen funds will be returned to affected community members, plus interest compensation for damages incurred.

The applause started slowly, then built like thunder rolling across the horizon until the entire room was standing, clapping, and cheering like their favorite team had just won the championship while simultaneously achieving world peace. That’s when Morrison gestured for me to join her at the podium, and I realized this moment had been carefully choreographed for maximum dramatic impact.

The success of this recovery operation was made possible by the unique cooperation of Mr. Ezra Blackstone, who revealed during our investigation that he is the actual owner of Regional Trust Bank, the very institution Ms. Hartwell had been systematically defrauding. The silence that followed was so complete, you could have heard a pin drop in the next county.

200 pairs of eyes stared at me like I just announced I was secretly Superman masquerading as a chicken farmer, which wasn’t entirely inaccurate given the circumstances. Morrison handed me the microphone with a smile that suggested she’d been looking forward to this particular revelation since the investigation began. Mr.

Blackstone, would you like to address your community? I looked out at faces that showed every emotion from amazement to gratitude to the kind of dawning understanding that comes when all the puzzle pieces finally click into place. These weren’t just neighbors anymore. They were people who’d survived a financial predator together and discovered they were stronger than anyone had imagined.

“Friends,” I began, my voice carrying across the room like a conversation between people who’d been through something extraordinary together. 4 months ago, Vivien Hartwell walked onto my porch and threatened to steal my family’s farm using fake debt claims and fraudulent legal documents. The sound of held breath filled the room as everyone leaned forward to hear the complete story they’d only known in fragments. and whispered conversations.

What she didn’t realize was that she was threatening to foreclose on property owned by the person who controlled every mortgage, every loan, and every financial instrument keeping this subdivision financially stable. Nervous laughter rippled through the crowd as people began appreciating the cosmic irony of a situation that belonged in textbooks about poetic justice.

I turned to face the cameras directly, knowing this moment would be replayed on news broadcasts across the country and referenced in federal fraud prevention seminars for years to come. Viven, your foreclosure papers are permanently denied. Your criminal enterprise is permanently closed, and your attempt to steal from this community has permanently failed.

6 months later, I stood in the community garden that had replaced Viven’s foreclosed mansion, watching three generations of families harvest vegetables they’d grown together while discussing mortgage refinancing that was saving each household an average of $400 monthly. The smell of fresh soil mixed with the sound of genuine laughter, a combination that had been missing from Hartwell Meadows for far too long.

Viven’s federal trial had been a masterclass in how not to defend yourself against overwhelming evidence. 24 months in federal prison, plus full restitution orders that stripped every luxury she’d purchased with stolen community funds. Her co-conspirator ex-husband received 18 months, and their fake bankruptcy attorney was disbarred before beginning his own federal sentence.

The asset liquidation recovered $1.1 million for direct community restitution, while civil lawsuits added another $200,000 in damages that would fund neighborhood improvements for years to come. Every stolen penny had been accounted for, tracked down, and returned to its rightful owners with interest that actually exceeded original losses.

As owner of Regional Trust Bank, I restructured every mortgage in the subdivision with reduced interest rates and extended terms that made home ownership genuinely affordable rather than a source of constant financial stress. Property values increased significantly once people realized their community was backed by honest financial management instead of criminal manipulation designed to extract maximum profit from residents desperation. Mrs.

Kowalsski had been unanimously elected as permanent HOA president on a platform of radical transparency that included monthly financial reports detailed enough that residents knew exactly how much was spent on every light bulb, bag of road salt, and blade of grass maintenance. Her board meetings featured homemade perogi and financial statements that could satisfy federal auditors.

Dimmitri supervised infrastructure reconstruction with the focusedintensity of someone finally getting to build things properly instead of hiding problems under cosmetic repairs that looked good just long enough to pass inspection. The subdivision’s roads, drainage systems, and common areas were now engineered to last decades, and the sound of construction equipment building better instead of covering up problems had become the soundtrack of community renewal.

Sarah established the Hartwell Heritage Scholarship Fund using recovered money to provide educational grants for students studying agricultural finance, sustainable community development, and ethical business practices. The $150,000 endowment had already awarded its first scholarship to a young woman planning to study sustainable community banking.

Apparently, the next generation was learning that farming and finance could work together instead of against each other. The converted mansion site became a community center and library where residents gathered for everything from children’s programming to financial literacy classes that ensured no future suburban tyrant could exploit people’s ignorance about banking regulations and legal rights.

Annual harvest festival celebrations combined agricultural heritage with suburban community building, creating traditions that connected people to both food production and neighborhood cooperation. My farm had expanded into a comprehensive community agriculture program where families could rent plots, learn sustainable living practices, and connect with food production in ways that suburban life typically doesn’t allow.

The scent of herbs and vegetables now mixed with suburban lawn care, creating an atmosphere that felt both productive and peaceful rather than artificially maintained through chemical dependence and regulatory intimidation. The broader impact exceeded anything we’d imagined possible. Our story inspired nationwide HOA financial transparency legislation that required detailed public reporting and resident oversight for all community association expenditures.

Regional Trust Bank became a model for community focused financial institutions with federal regulators using our fraud detection and community development programs as examples of how banks should actually serve customers instead of exploiting them for maximum profit extraction. Several communities contacted me weekly for advice about their own HOA problems, discovering that Viven’s combination of financial manipulation and community intimidation was unfortunately common throughout suburban America.

My investigation techniques were helping expose similar tyrants across multiple states, creating a network of communities learning to protect themselves from predatory leadership. But the most satisfying change was something you could feel during evening family walks. Children played in yards without parents worrying about HOA violation notices.

Neighbors actually talked to each other instead of communicating through lawyers and formal complaints. The sound of lawnmowers was regularly interrupted by block parties, community barbecues, and impromptu gatherings that built genuine relationships instead of enforced compliance. Mrs. Patterson’s weekly coffee group for elderly residents ensured that no one would ever face financial threats or intimidation alone again.

The group met in my kitchen most Tuesday mornings, partly for the coffee and partly because they enjoyed sitting around the same table where Vivien had once threatened to steal everything. Standing there watching sunset paint the sky above my great-grandfather’s farmhouse, I realize something profound. Sometimes the best revenge isn’t destroying your enemies.

It’s building something so much better than what they tried to tear down. that future generations will never understand how anyone could have chosen fear over community, theft over service, or power over genuine leadership.